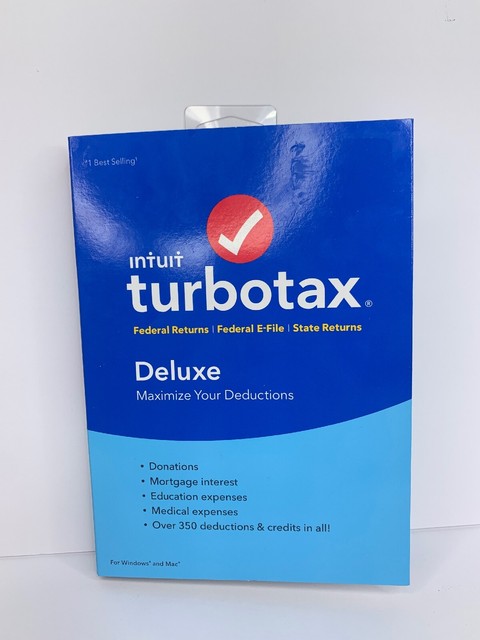

- #Turbotax deluxe with state +2018 update#

- #Turbotax deluxe with state +2018 software#

- #Turbotax deluxe with state +2018 free#

You'll know right away why you got the amount you did for certain tax breaks. You can choose to pay for right out of your federal tax refund.

#Turbotax deluxe with state +2018 free#

#Turbotax deluxe with state +2018 update#

We display and update your federal and state tax refunds (or taxes due) as you do your income taxes, so you always know where you stand. We automatically save your progress as you go, so you can always pick up where you left off.

For those taking the standard deduction, Form 1040-SR includes a chart listing the standard deduction amounts, making it easier to calculate. Taxpayers who itemize deductions can file Form 1040-SR with a Schedule A, Itemized Deductions, when filing their return. The revised 2019 Instructions cover both Forms 10-SR.Įligible taxpayers can use Form 1040-SR whether they plan to itemize or take the standard deduction.

All lines and checkboxes on Form 1040-SR mirror the Form 1040, and both forms use all the same attached schedules and forms. Seniors can use Form 1040-SR to file their 2019 federal income tax return, which is due April 15, 2020. The form allows income reporting from other sources common to seniors such as investment income, Social Security and distributions from qualified retirement plans, annuities or similar deferred-payment arrangements. Taxpayers born before January 2, 1955, have the option to file Form 1040-SR whether they are working, not working or retired.

#Turbotax deluxe with state +2018 software#

More than 90% of taxpayers now use tax software to prepare and file their tax return. Taxpayers who electronically file Form 1040-SR may notice the change when they print their return. Form 1040-SR, when printed, features larger font and better readability. Taxpayers age 65 or older now have the option to use Form 1040-SR, U.S. The Bipartisan Budget Act of 2018 required the IRS to create a tax form for seniors. WASHINGTON ― The Internal Revenue Service wants seniors to know about the availability of a new tax form, Form 1040-SR, featuring larger print and a standard deduction chart with a goal of making it easier for older Americans to read and use.

0 kommentar(er)

0 kommentar(er)